Introduction

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home repair, or a sudden opportunity that requires immediate funding, having access to quick financing options is crucial. Zoca Loans is a reputable lending institution that specializes in providing fast and convenient loans to individuals in need. With their streamlined application process and competitive interest rates, Zoca Loans has become a go-to choice for many borrowers. In this article, we will explore Zoca Loans for quick financing, diving into their services, benefits, and frequently asked questions.

What is Zoca Loans?

Zoca Loans is a leading online lending platform that aims to simplify the borrowing experience for individuals who require quick financing. With their user-friendly website and efficient loan application process, Zoca Loans makes it convenient for borrowers to access the funds they need in a timely manner. They offer a range of loan options, including personal loans, installment loans, and payday loans, catering to different financial needs.

Benefits of Choosing Zoca Loans

When considering Zoca Loans for quick financing, there are several benefits that borrowers can enjoy:

- Easy Application Process: Zoca Loans provides a simple and straightforward online application process. Borrowers can complete the entire application from the comfort of their own homes, eliminating the need for lengthy paperwork or in-person visits to a physical branch.

- Quick Approval: One of the main advantages of choosing Zoca Loans is the speed of approval. Upon submitting the loan application, borrowers can receive a decision within minutes, allowing them to access funds swiftly.

- Flexible Loan Options: Zoca Loans offers a variety of loan options to cater to different financial situations. Whether you need a short-term payday loan or a longer-term installment loan, Zoca Loans provides options that align with your needs and repayment capabilities.

- Competitive Interest Rates: Zoca Loans strives to offer competitive interest rates to their borrowers. By comparing rates with other lenders in the market, Zoca Loans ensures that their customers receive fair and affordable terms.

- Transparent Terms: Transparency is a core value of Zoca Loans. They provide borrowers with clear and concise loan terms, ensuring that there are no hidden fees or surprises throughout the borrowing process.

- Secure and Confidential: Zoca Loans values the privacy and security of their customers’ personal and financial information. They employ industry-standard security measures to safeguard data, giving borrowers peace of mind.

Applying for a Loan with Zoca Loans

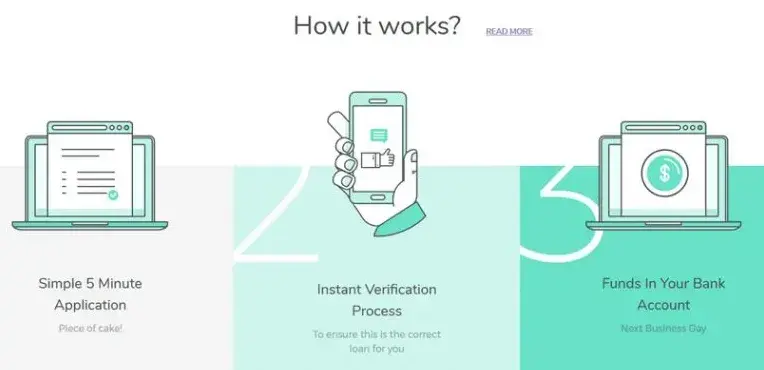

Exploring Zoca Loans for quick financing is a simple and hassle-free process. Here’s a step-by-step guide on how to apply:

- Visit the Zoca Loans Website: Start by visiting the official website of Zoca Loans at www.zocaloans.com.

- Create an Account: Click on the “Apply Now” button and follow the prompts to create an account. You will be required to provide some basic personal information during this step.

- Submit Your Loan Application: Once you have created an account, log in and fill out the loan application form. Make sure to provide accurate and up-to-date information to expedite the approval process.

- Review and Accept the Terms: After submitting your application, carefully review the loan terms and conditions provided by Zoca Loans. If you agree to the terms, accept the offer to proceed with the loan.

- Receive Funds: Upon acceptance, Zoca Loans will process your loan, and if approved, the funds will be deposited into your designated bank account within a short period.

Frequently Asked Questions (FAQs)

Can I apply for a loan with Zoca Loans if I have bad credit?

What is the maximum loan amount I can get from Zoca Loans?

How long does it take to receive a decision on my loan application?

Are there any upfront fees associated with applying for a loan from Zoca Loans?

Can I repay my Zoca Loans early without any penalties?

What happens if I miss a loan repayment with Zoca Loans?

Conclusion

When it comes to quick financing, Zoca Loans stands out as a reliable and customer-focused lending institution. With their commitment to transparency, competitive interest rates, and efficient loan application process, Zoca Loans offers a convenient solution for individuals in need of immediate funds. Whether it’s for unexpected expenses or seizing an opportunity, exploring Zoca Loans for quick financing can provide the financial support you require.